Risk & Compliance

In an context where globalization intensifies, and where risks and regulatory requirements are constantly on the rise, permanent process improvement & continuous risk monitoring become critical factors for company performance.

![]() Our Expertise in “Risk & Compliance

Our Expertise in “Risk & Compliance

Through process mapping and process reengineering, risk assessment and risk management, we enable you to size the opportunity to mobilize your managers to lead successful company transformation along 3 axes:

⟜ Effectiveness

⟜ Efficiency

⟜ Pragmatism

We map your business processes

⪧ Formalization of most relevant representation rules

⪧ Process architecture, processes and activities modelling

⪧ Selection & implementation of tailored BPM software

We harmonize and optimize processes

⪧ Performance improvement combining top-down & bottom up approach

⪧ Process reengineering (TQM, Lean 6 Sigma) and evolution to adapt them to a digital company context

We strengthen your risk management

⪧ Risk identification and assessment, Control plan Design

⪧ Risk monitoring and performance simulation (BAM software)

We lead efficient regulatory projects

⪧ Complement and reinforcement to your regulatory teams

⪧ Advisory based on our extensive banking (ACP, BDF, BCE) and financial expertise, in particular for investment management companies (AMF and BDF)

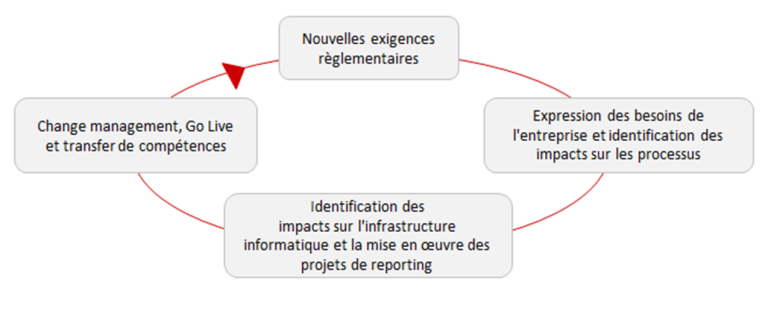

We steer and implement regulatory programs

⪧ Project and stakeholder coordination

⪧ Support in optimizing your unified financial reporting system

⪧ Project steering and project-induced risk management, delivery management and reporting timeline guarantee

DPC Asia Ltd has compiled a modular offer to support you in the definition and implementation of financial and regulatory reporting projects thanks to:

⪧ Our comprehensive expertise of project management and regulatory compliance matters

⪧ Our objective and unbiased advice (independent from software editors)

⪧ Our transparent and pragmatic approach

On top of our methodology, we bring to the table our strong operational experience in:

⪧ Optimization of financial reporting systems

⪧ Project and risk management support

⪧ Management support for projects related to review and assessment of IT systems

Past assignments

Design and implementation of a control plan to ensure global compliance with regulatory requirements and internal controls for an international Corporate & Investment Bank

⪧ Analysed the procedures of the Corporate Banking department of a bank in APAC by leveraging available documented procedures and checklists, and conducting workshops with the operations teams and management

⪧ Designed and tailored the self-declarative control plan, paying particular attention to regulatory and anti-money laundering related controls (compliance with HKMA/MAS/CBRC requirements)

Design of an Operational Risk Management framework for a leading global Bank

⪧ Designed and deployed a two-level Operational Risk Management framework across various business lines (Fixed Income, Equity & Derivatives, etc.) and locations worldwide (APAC, EMEA, Americas)

⪧ Validated the framework with both operations team management and internal second level controls team

⪧ Implemented the framework within the chosen BPM and Control tool

⪧ Conducted technical trainings to operations teams, ensured Go Live and handed over operational risk management to operations teams as well as system maintenance to internal IT teams

Deployment of a consolidation & reporting tool for a large European banking group

⪧ Coordinated and harmonized Finance procedures, workflows and reporting format at Group Level

⪧ Planned and executed the redesign of the consolidation and reporting tool (identification of IT requirements for the new tool, project management and implementation of new processes)

⪧ Reengineered the workflow for group reporting, defined new monitoring indicators and monitored the implementation of the tool